Journey from Good to Great

Essentials for Getting to the next level

Finance for Entrepreneurs at Emerging Corporates (SMEs)

Raising Capital from Private and Public Sources

Capital has always been a major challenge for promoters. Let us start with asking Emerging Corporates/SMEs following questions:

Have you been looking to raise capital either equity or debt to grow and expand your business.

Do you feel raising debt capital from banking sector (generally being collateralized) is a significant challenge. Alternative sources of debt are exorbitantly expensive.

Do you feel equity capital from Private sources (Private Equity and Venture Capital) is emerging fast in the country. But, you don’t know how this whole stuff works.

Do you feel SME platforms of Bombay Stock Exchange and National Stock Exchange may help you raise capital from public in a much more simplified manner (some SMEs have already raised capital from these platforms) but you don’t know how does it work.

This Programme would provide solution to the SME companies struggling with above questions through highlighting how SME companies can access equity capital from Private sources (Private Equity/Venture Capital) and/or from public (Initial Public Issue – IPOs) through recently launched Small and Medium Enterprises (SME) platforms of Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

This programme is conceptualized to provide a pragmatic perspective on various aspects of accessing equity capital from Private sources and/or public through SME platforms of BSE and NSE.

Course Contents:

Various sources of finance for the companies – Public and Private Markets

Consideration in various financial instruments – Equity, Debt, Preference Shares, Convertibles, etc.

Structure of VCs/PEs and their mandate

Focus of VCs/PEs – Their thought process on financing companies

Perspective of VCs/PEs while providing funding

Considerations of companies while sourcing PE/VC funding

Preparation of information memorandum

Financial data – important ratios and sensitivity analysis

A typical deal process and time lines

Valuation approaches - Discounted cash flow, Relative Valuation etc.

Legal framework and exit routes

Nuances of raising capital from SME platforms of BSE and NSE

Eligibility criterion for raising capital

What amount can be raised

What is the process flow and time lines

How to prepare for IPO through SME platform

What are the costs involved

Who all to facilitate the process intermediaries involved in the IPO process

How is this platform different from BSE/NSE main platform

How can companies migrate from SME platform to BSE/ NSE main board.

Case study of already listed companies on BSE/NSE SME platforms

CEOs, CFOs, Proprietors, Partners, Directors and Senior Management of emerging corporates/SMEs. Senior Management of large corporates may also join in to see how they can facilitate efficiency and effectiveness at the end of their business partners - vendors. We also encourage Consultants, Bankers and practicing CAs, CSs etc. to join this programme along with their promoter partners.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

1 day to 2 days (Contents to be customized as per the chosen tenor and requirements).

Chanakya in Arthashastra stated ‘Finance’ to be one of the seven pillars of nation building. Indeed, nothing works in this world without money and every idea needs to be nurtured with finance. It is often said “Entrepreneurs and Decision makers need to understand financials to complete their understanding of undertaken projects/decision situations”. As all actions of business on products, markets and strategies ultimately boil down to financials, developing basic understanding on financial aspects of business does create competitive advantage for entrepreneurs and decision makers.

Some of the questions, continuously asked by Entrepreneurs at Emerging Corporates/SMEs are:

What are the various sources of funds (long term and/or short term) along with their competitive advantages and dis-advantages?

How to analyze my business performance and also carry out comparison with peers in the industry?

What are important financial parameters, top people need to focus on?

What is the value of my business and how to enhance this further?

Answers to all these questions are not straight forward as they are the function of nature of businesses. However, if one develops broad understanding on the subject that will help in asking right questions ultimately leading to appropriate answers. Accordingly, this programme is structured to answer to above questions in a systematic manner.

Course Contents:

Sources of capital for businesses – Public and Private Markets

Consideration of various financial instruments – Equity and Debt

Uses of capital – long term assets and working capital

Thought process and perspective of lenders and/or equity investors – IPO, Private equity, Individual private investors.

Broad understanding of business financials – Profit and loss account, Balance Sheet and Cash Flows

Performance Analysis – important financial parameters/ratios and their implications

Sources of value in a business – Earnings and Assets

Broad sense of valuation of business – Earnings based and Assets based

Simple ways to enhance value of businesses

Understanding implications of corporate actions like dividend, bonus, split etc.

CEOs, CFOs, Proprietors, Partners, Directors and Senior Management of emerging corporates/SMEs. Senior Management of large corporates may also join in to see how they can facilitate efficiency and effectiveness at the end of their business partners - vendors. We also encourage Consultants, Bankers and practicing CAs, CSs etc. to join this programme along with their promoter partners.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

There is no magic formula for success, anywhere. Getting to the next level in anything demands differentiated perspective and approach. Start of this change in business always happens with change in the mindset/thought process of Promoters/ Business Leaders. Accordingly, this programme is envisaged to sow those relevant essential seeds of success at the level of Promoters/ Business Leaders.

Objective of this programme is to discuss step by step process of migrating a company from “Emerging to Emerged” and building organizations that outlive individuals. As thoughts need to change before reality, this programme would focus on influencing ‘Mindset’ of Promoters/Business Leaders by making them think differently on variety of business issues. We would discover, together, Essential Success Factors for taking businesses to the next level (along with some interesting case studies).

Course Contents:

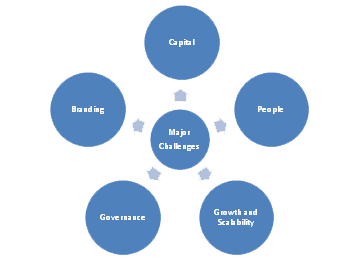

Research shows that 80 – 85% challenges in businesses are common and can be broadly captured as follows:

Accordingly, focus of discussions would be on following topics:

How “Preparedness of Mindset” is a pre-requisite for building great organizations

How to build a great team while there are cash flow constraints

How to create scalable business through institutionalization of organization structure

How to raise capital (Equity and/or Debt) by becoming a deserving candidate

What important financial factors to focus on

How to build a strong value proposition for customers

How to escape competition through differentiation

How good governance adds value to business in long run

How to build valuations and unlock them over a period of time

How change in positioning and Branding changes valuations

CEOs, CFOs, Proprietors, Partners, Directors and Senior Management of emerging corporates/SMEs. Senior Management of large corporates may also join in to see how they can facilitate efficiency and effectiveness at the end of their business partners - vendors. We also encourage Consultants, Bankers and practicing CAs, CSs etc. to join this programme along with their promoter partners.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

“Emerging to Emerged” is a journey, which needs vision, thinking, planning and great execution. Pre-requisite to all this is a positive, constructive, forward looking and enterprising “Mindset”. Ability of promoters/business leaders to ask right questions and exploration of their answers can significantly distinguish an organization from others. As Promoters/Business Leaders, have you ever asked following questions to yourself?

How do we become a deserving candidate for capital (from Banks, private investors and/or public)

How do we become a honey-pot for attracting and retaining great talent

How do we structure our business model to attract customers

How would good governance add value to business and valuations

What is the opportunity cost of not doing right things

This programme is carefully conceptualized and designed, to specifically address above questions in practical manner.

Course Contents:

Capital is fuel for any business. Both debt and equity have their positives and negatives. We will dwell on broader issues with regard to capital structure (existing and future), various sources of finance for a business and their long term impact (ownership, liquidity, cost, exits etc.). We will discuss - what investors and bankers look for in businesses and how to position the pitch to them.

Both BSE and NSE have launched SME platforms for listing of emerging corporates/SMEs in 2012. Benefits of listing are many in terms of access to capital and improved perception of stakeholders in business. Already, there are several companies listed on these two platforms. How can these platforms help you raise capital and unlock real value of your business?

Credit rating is a pre-requisite for many businesses, when it comes to raising debt. It is good to understand how rating agencies look at businesses and how can corporates improve their credit rating. Another important aspect of discussion would be how does credit rating create value for the businesses.

Growth and scalability are most magical words for promoters, investors and lenders alike. However, businesses need serious thinking on organic vs. inorganic growth (growth through acquisition) and corresponding strategies. Growth and scalability may demand infusion of significant resources (capital and otherwise) before businesses see profitability. Businesses need to focus on brand management, market positioning, customer outreach, customer engagement and distribution network.

Inorganic growth may be accomplished through acquisition of businesses. Similarly, after a stage, promoters may not be interested in running a business or may be interested in doing something else. Both these situations demand a suitable match post the strategic deliberations and end to end closure of transactions. Motives, process and major challenges would be the focus of our deliberations here.

“Restructuring”, “Cost-Cutting”, “Downsizing” etc. are buzz words in corporate circles from time to time. Sometimes, even successful and well run companies encounter difficulties as a result of hyper competition, market volatility, downturn in economic cycles and other factors beyond their control. During these times, quick assessment of challenges and unemotional decision making becomes key to survival in short term and profitability in long-term.

Business transformation gets sparked with change in thought process of promoters. Number of times, it just demands more organized approach to business and setting up priorities well, focusing on few things and saying no to others. Businesses need to focus on improving health, and, resultantly enhance their valuations. Focus of discussion here would be key drivers of business transformation.

Business environment is becoming increasingly complex and making many of us redundant at an amazing speed. Yesterday’s competencies are no more value adders. Accordingly, both individuals and organizations need to be learning machines. Further, focus of learning has to be on building conceptual clarity, a broad perspective and ability to handle situations with clear focus on solutions.

Most of the businesses in India are family owned. At some level in their life cycle, promoters feel the need to infuse talent from outside to enhance competence and continue on the journey of growth. Indeed, investors/lenders also want to see management breadth before committing capital. We will discuss importance of credible sounding board, segregation of ownership and management, setting up human resource systems (recruitment, key result areas (KRAs), appraisal etc.), setting up Standard Operating Procedures (SOPs) for each department/vertical and Management Information Systems (MIS) etc.

Another area of debate with Family Owned Enterprises is succession planning. One has to ensure transition of business from one generation to another is smooth and the interest of retiring generation is well protected.

World markets have witnessed unprecedented moves across the asset classes – Commodities, Securities, Currencies and Rates etc. Top managements, across the businesses, has voiced concern on the subject of risk management. Implications of changing asset price dynamics in the market place are many – For instance, increasing commodity prices and inability to pass on the escalated prices to customers, because of competitive pressures, infuses uncertainty in cash flows and squeezes profit margins. Similarly, sometimes, unexpected currency moves may evaporate profit margins on sale and jeopardize very existence of organizations.

CEOs, CFOs, Proprietors, Partners, Directors and Senior Management of Family Managed Businesses/Emerging Corporates/SMEs. Senior Management of large corporates may also join in to see how they can facilitate efficiency and effectiveness at the end of their business partners - vendors. We also encourage Consultants, Bankers and practicing CAs, CSs etc. to join this programme along with their promoter partners.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

Address :

Value Ideas Investment Services Pvt. Ltd.

301/Wing A, Golden Rays, Raheja Vihar, Powai, Mumbai – 400072, INDIA.

© 2016 Xcelerating Minds. All rights reserved. | Designed & Developed By TechnoBase IT Solutions Pvt Ltd.

Sunil brings to the team 35 years of SME business, legal, taxation and real estate experience. He is also an investor both in listed and unlisted space businesses. His common sense approach to legal, taxation and business issues is always a great value creator for business.

He has done SME Programme from Indian Institute of Management, Ahmedabad. He also holds Bachelor’s degree in Commerce from Mumbai University.

He can be reached at sunil@Xceleratingminds.com

Manish brings to team over 20 years of experience in diverse fields including Investment Banking and consulting (SME Value Advisors), listed space investing (Jeetay Investments Pvt. Ltd., India), sales and business development (Citibank, India), regulatory (Securities and Exchange Board of India – SEBI, India) and business analysis (Institute of Chartered Financial Analysts of India – ICFAI, India). Diversity in his experience imparts him with great ability to structure issues and synthesize potential solutions in any given business situation.

He has done his M.S. in Business Administration from University of Maryland, U.S. He also holds other degrees like MBA, CFA and Licentiate in General Insurance.

He has been sharing knowledge continuously from different platforms such as Bombay Stock Exchange (BSE), National Stock Exchange (NSE), Multi Commodity Exchange (MCX), Dun and Bradstreet (DnB), Credit Rating and Information Services India Ltd. (CRISIL) and various industry bodies like FICCI, ASSOCHAM, CII etc. He also serves as visiting faculty to prestigious Institutes including Indian School of Business (ISB), Hyderabad, Indian Institute of Management (IIM), Bangalore, Indian Institute of Technology (IIT), Mumbai and several others. In addition, he has several publications to his credit.

He can be reached at manish@Xceleratingminds.com

Athithya brings with six years of experience providing exemplary support in IT industries. Consummate multi-tasker who can balance competing and shifting priorities with ease. In span for 6 years worked for multinational to Start-ups Company. Expertise in digital marketing as well as Business Development and helped 50+ start-ups to gain brand in market place.

She earned her Master of Business Administration from Madurai Kamaraj University, Tamil Nadu. Her responsibility here includes enhancing the training and programmes as well as increase the brand awareness to various educational sectors.

She can be reached at athithya@xceleratingminds.com

Chaitri brings 2 years of mixed bag experience in investment banking & marketing. She is a team player, a multi tasker & can manage priorities in time with ease. She has earned her Bachelors & Master’s degree in Financial Markets from Mumbai University & IGNOU’s affiliation with Bombay Stock Exchange(BSE) simultaneously. Her role at Xcelerating minds involves conducting training programmes & enhancing brand awareness within the corporate sector.

Ranjana Bang brings 2 year experience in marketing, worked with Computer Institutes - Tata Unisys and NIIT as marketing executive. She had done graduation in Science and M B A in marketing from Marathwada University Aurangabad. She had also done 1 year diploma in Computer software.

She can be reached at ranjana@xceleratingminds.com

Parag is a graduate in Bachelor of Commerce with Masters in Business Administration in marketingand is based in Mumbai. He is a seasoned professional with experience of over 30 years in Sales, Marketing and General Management: largely in the Office Automation, Risk Management, Consulting, Research& Credit Rating Industries. Parag has workedwith reputed institutions in their startup phase and was a key member of various teams set up tonurture the companies towards sustainability. These companies include: Xerox Corp (earlier known as Modi Xerox Ltd), RPG Ricoh Ltd,Dun& Bradstreet India & SMERA Ratings Ltd.

Further, Parag played a pivotal role at Dun & Bradstreet (D&B) in India & the Middle East by setting up its sales division for Risk Management, Researchas well as Advisory practice with a career spanning over 14 years with them. Before joining his latest firm: Equentis Wealth Advisory Services, where Parag was instrumental in setting up investment as well as research divisions & procuring SEBI license, he was a CEO of SMERA Ratings Ltd (a joint venture of SIDBI//D&B and various banks) with an eventful career spanning 6 years at the helm. During this stint at SMERA, Parag managed to convert a loss making business to a profit making & a dividend paying company.

In the process of building these companies from a startup phase, Parag has learnt the most difficult art in management: building and managing companies to a sustainable phase.Creating and training sales teams has been Parag’s key skill set acquired during his career spanning over 30 years.

For Parag, who is steeped in legendary RankXerox’s sales & other variant of its trainingregimen (also consultative training skills from Dun & Bradstreet), training comes naturally to him.Paragbelieves in creation of high performance and ownership driven teams wanting to contribute to thebest of their capabilities.In all the companies that he has worked in the leadership position since RPG Ricoh, he was instrumental in developing strong leaders within his team who occupy key positions in various firms. Parag’s successful stint at the firms mentioned above stems from his keen eye in spotting talent, nurturing them and imbuing them with team spirit to achieve company goals. He is a firm believer in building cohesive culture striking balance in performance, rewards, ethics& accountability.

During his 20 years with Dun & Bradstreet and SMERA Ratings Ltd experience, Parag has presented to domestic as well as international audience comprising of bankers, regulators, credit guarantors, various industry associations, exporters, International multilateral & govt. agencies thus exposing him to multifarious audiences, thereby honing his presentation skills to suit his audiences. Thus, amongst various skills, strong presentation skill is one of Parag’s key professional strength acquired while working in the corporate set up.

Parag is married with 2 children and resides in Thane.

Murali brings to the team more than 25 years of illustrious experience in the field of Finance, Accounts, Taxation, Legal and Corporate Finance. His fields of expertise are project finance, working capital management, audits, taxation both direct & indirect taxation, compliance and due diligence (s), secretarial and corporate law matters. In-depth understanding of business issues and eyes for details make him a great resource for team.

His academic record is quite exemplary with high ranks in all the professional examinations such as CWA, CA, CS, M.Com, LLB and MBA (project finance).

He can be reached at murali@Xceleratingminds.com

Rajesh brings to the team around 20 years of extensive experience in the industry including over 10 years in Asset Management and Investment Advisory. He is currently an Investment Consultant to a large family office based in Dubai, UAE. Previous to that he was associated with “Credit Suisse, Dubai” as an External Fund Advisor to provide non-discretionary Investment Advisory and Portfolio counselling services to High Net-worth Individuals. Rajesh also worked with Lucros Capital Advisors Limited – A DFSA regulated Hedge Fund as Head – Research and Esvee Capital, a proprietary Fund owned by a large family office in UAE as Sr. Equity Analyst. He has extensive experience in setting up regulated GP and fund structures in Dubai (DFSA) and Cayman Islands/Mauritius; his key competency areas are equity research, data analysis with an understanding of business requirements in various international environments and he is well versed with regulatory requirements for financial services in different geographies such as India, UAE, Cayman Islands, and Mauritius.

He is a Chartered Accountant (ACA) and has Executive MBA degree from NMIMS, Mumbai.

He can be reached at rajesh@Xceleratingminds.com

Sheetal brings to the team more than 10 years of general administration, project management and marketing experience. Over the years, she has been working with start-ups and involved in Strategy formulation and business development. Also, over last 5 years, she has been associated with ShreenathjiDyanda Charitable Trust (SDCT) as Committee Member and administrator at SDCT’s Technical Institute.

She earned her Bachelor’s in Pharmacy from Pune University and Post Graduate Diploma in Pharmacy Management (PGDPM) from SIES College of Management Studies, Mumbai.

She can be reached at sheetal@Xceleratingminds.com

Dr. Abhijit is Director at Giltedge Financial Counsel Pvt. Ltd.He brings with him more than 30 years of experience in consulting and strategic management with specific focus on new business initiatives. He has worked in senior positions with Indian subsidiaries of two global investment banks, served on the board of a leading co-operative bank, spent time with manufacturing and consulting sectors in a wide variety of interesting engagements. Understanding of business issues and eyes for details make him a great resource on Financial Modeling and Business Valuation, end to end structuring and integration in Mergers and Acquisitions, setting up internal procedures and operations in businesses etc.

His academic record is quite exemplary with high ranks in all the professional examinations such as CWA, CA, CS and CFA. He was recently awarded a PhD by IIT Bombay for his pioneering work on ‘Factors influencing investments into Indian states’.

He has been sharing his experience through executive education engagements, delivered through various platforms including Dun & Bradstreet, CRISIL, Shailesh J. Mehta School of Management, IIT Bombay, Giltedge Financial Counsel Pvt. Ltd. and several other esteemed organizations.

Dr. Anil Menon brings with him more than twenty years of experience in the field of Financial Services & Investment Banking. He is known for his skills on Financial Modeling, Business Valuations, Mergers and Acquisitions and issues in Family Managed Businesses (FMBs). His tenure as Assistant Vice President at SBI Capital Markets Ltd., a premier investment bank in India, has equipped him with necessary investment banking competencies. He is also closely associated with Family Managed Business (FMB) program at S. P. Jain Institute of Management and Research, Mumbai.

His academic qualifications include Bachelors in Production Engineering from Mumbai University, Master of Management Studies (MMS) from Jamnalal Bajaj Institute of Management Studies and doctorate in Mergers and Acquisitions.

He is a sought after speaker and shares his knowledge from various prestigious platforms on Financial Markets and Investments. He has conducted customized training on Corporate Finance, Financial Modeling and Structuring for SBI Capital Markets, Godrej Industries, General Motors, Patni Computers, GVK, HDFC Standard Life, ILFS etc.

Gurudatta has around one and a half decades of extensive experience in Equity Research, Investment Advisory and Portfolio Management. Along with his entrepreneurial stint in initial phase of his working life (civil contract and interior designer), he has worked with reputed securities broking firms such as MotilalOswal and Almondz supporting proprietary Trading desks and clients such as Bank treasuries and Mutual funds.

His key competency areas are Training and Research. He used to be quoted in print media quite often and appeared on TV continuously between 2008 to 2010. His excellent communication skills and command over the basics of finance have taken him to various reputed platforms to share his knowledge – Bombay Stock Exchange (BSE), National Stock Exchange (NSE), NISM and several prestigious Institutes including Jamnalal Bajaj Institute of management Studies (JBIMS), Government Law College (GLC) etc.

His academic qualifications include B.E Civil and ‘Certificate course on Capital Market’ from BSE Institute Limited.

Sumita Datta (PhD) is Managing Partner at Bridgit Nterprise LLP, an OD Consulting, Training and Coaching organization, concentrating on organizational capability building and leadership development. In addition, she is Associate Professor (adjunct) in the People &Performance area at S.P. Jain Institute for Management & Research, Mumbai. She is also SHRM India Master Facilitator. In independent capacity as well as a Senior Associate with Grow Talent and Great Place to Work, India, she successfully completed several assignments for medium and large corporate houses dealing with change management, vision & mission exercises, career transitioning, competency assessment, talent management, leadership development and other critical people interventions since July 2005. From July 2012till September 2013, she headed the Learning and Leadership Development function of Siemens (South Asia) based out of Mumbai, responsible for driving their talent strategy in the South Asia region through a robust Learning & Development landscape.

A Post Graduate in Personnel Management & Industrial Relations from XLRI Jamshedpur (1992) with academic Concentration in Organization Behaviour, she received her PhD. from IIT Bombay in2010. She is a certified MBTI, Saville, EQi 2.0 and NLP Practitioner. She is a certified Integral Coach of New Ventures West, USA and Associate Certified Coach from ICF. Prior to joining academics in 2009, Dr. Datta has had full time corporate experience of more than 15 years since 1992. As HR Manager in Eveready Industries (Nov. 1992 - Sep. 2000), she focused on post- acquisition cultural integration, Training & development, corporate restructuring among other operating responsibilities during her tenure. As Head HR- Corporate Centre, Mahindra & Mahindra Ltd.(July 2001 – June 2004) she acquired extensive experience in the areas of Organizational Change and Development, Resourcing, Performance Management, Compensation Management, HR Information System and HR support to incubating group companies.

In her academic role at S.P. Jain, Dr. Datta is actively engaged in evolving the organizational and family processes in the Family Managed Businesses, which have tremendous potential for growth. With special interest in enriching the role of women in the sphere of business, she conducts specialized programs for women leaders.

Dr. Datta has co-authored several scholarly articles in refereed journals such as Career Development International and IMR as well as International Conference Proceedings. Her research paper on Talent Development Climate, got acclaimed in the Best Paper Award (2012) category by the Academy of Management, Boston USA.

Ramu Shankarrao has over 23 years of experience in Healthcare industry with giants like Medtronic and St. Jude Medical. His last corporate assignment was with St. Jude Medical as Director of sales and marketing responsible for growing and managing the business and teams in South Asia. Subsequently, he had a short stint in academia with S. P. Jain Institute of management and Research, Mumbai for about 3.5 years teaching and researching in the area of sales, marketing and business plan.

He is the founder and Director of Sangatikarana Corporate Service Private Limited. In his current role, he works with companies to drive sales and marketing efforts, strategy and organization growth. He advises clients ranging from Fortune 500 companies to family-owned business. He coaches business owners and professionals towards achieving the revenue and profit growth. He spends much of his time coaching senior leaders on how to align their teams for ultimate success.

He is a passionate trainer and has conducted training programs for companies like Covidien, Kimberly Clark, Medtronic, Cisco etc. By way of skill building programs, he helps companies build strong frontline sales team to SBU heads. He received his postgraduate and undergraduate degrees from Karnataka University.

Manish Bansal is an Entrepreneur, Investor, Author and Keynote Speaker. At present, he is CEO of SME Value Advisors, an investment and consulting firm, which partners with Emerging Corporates/SMEs to take them to the next level. Over last 20 years, he has worked with several reputed organizations such as Citibank, Securities and Exchange Board of India, Institute of Chartered Financial Analysts of India etc.

He has been a speaker in various programmes, both National and International, organized by distinguished institutions such as Bombay Stock Exchange (BSE), National Stock Exchange (NSE), Multi Commodity Exchange (MCX), Dun and Bradstreet (DnB), Credit Rating and Information Services India Ltd. (CRISIL), Institute of Chartered Accountants of India (ICAI), Institute of Company Secretaries of India (ICSI) and various industry bodies such as FICCI, ASSOCHAM, CII etc.

He has also visited various prestigious Institutes including Indian School of Business (ISB), Hyderabad, Indian Institute of Management (IIM), Bangalore, Indian Institute of Technology (IIT), Mumbai and several others as a speaker. In addition, he has several publications to his credit including a book published by McGraw Hill– “Derivatives and Financial Innovation”.

Academically, he has done his M.S. in Business Administration from University of Maryland, U.S. He also holds other degrees like MBA, CFA and Licentiate in General Insurance.