One of the most important resources for organizations is People; as the quality of delivery and services to customers is always intrinsically linked to the quality of individuals in the organization. People being the key to delivery, they need to be agile and be ready to learn as businesses are ever evolving without fixed operational paradigms. Further, customers are becoming demanding beyond imagination asking for better, faster and cheaper products and services.

In this environment, to keep ahead of the competition, it becomes imperative for organizations to offer their employees a platform to continuous broaden their thought process and upgrade their competence set to become better individuals, better team players and better businessmen with clear focus on value delivery to the customers.Accordingly, businesses strive to offer an energetic and enterprising environment to their employees and an opportunity to continuously upgrade through both internal and external interventions.

With our carefully crafted interventions on Leadership Development, Soft Skills and Functional Areas (Marketing/Sales, Finance etc.), we have been adding value to organizations more than over two decades. Whether your company is large or small, at growth stage or mature, local or international, our carefully designed programmes and competent trainers would be able to make positive impact on your profitability through enhancing skill levels, performance and productivity of your people.

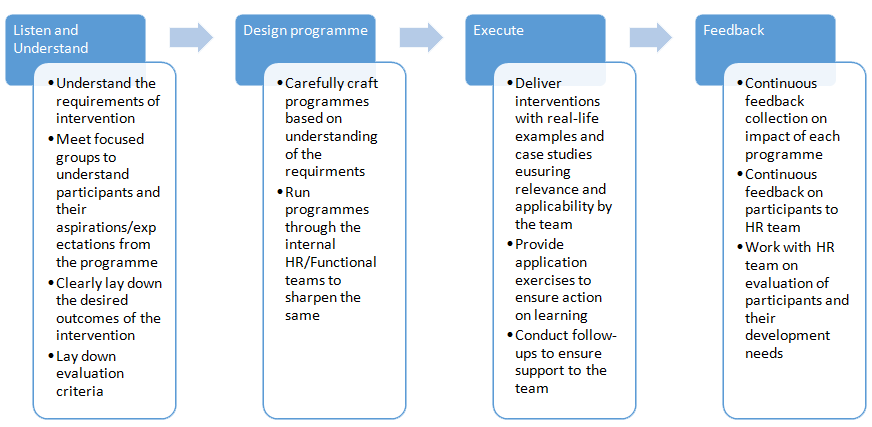

As a process, our impact cycle works as follows:

Our programmes are differentiated in following manner:

We undertake only tailor made programmes to make impact. We engage with Corporates with a broad perspective, focus on clearly defining challenges/problems, co-designing solutions and then executing them to accomplish desired results with long term positive impact on people.

We approach trainings/interventions from practical and execution perspective addressing each of the identified challenges/pain points. Most of our trainings/interventions are handled by senior practicing professionals with significant real life relevant experience and passion to spark the change around.

We set out clear and measurable goals (milestones) for our engagements. Our relentless focus is on ensuring Return on Investment (ROI) to our partnering Institutions.

We have built a team with significant competence to cater to diversified and ever changing needs of Corporates at different stages of business. Further, we have demonstrated track record of value creation in training space, over two decades, with Institutions both in India and Abroad. We do not undertake an assignment until we see a clear value addition through engagement, because, we value your resources – both time and money.

While below is list of some indicative programmes, we would be happy to co-design specialized programmes with your HR/Functional team to truly make an impact:

Leadership Development Programmes

Leadership Development Programme for Middle Management

First Time Managers Programme

Functional Managers to Business Managers

Out-door Training Programmes with various themes

Journey from Good to Great

Soft Skills Trainings

High impact presentations

Communication and presentation skills to win stakeholders

Email Etiquettes

What they don’t teach you at B-Schools

Business Development/Marketing/Sales

Customer Retention and Engagement

Key Account Management

Finance

Finance for Non-Finance Managers and Decision Makers

Financial Risk Management

Financial Modelling for Decision Making

Workshop on Business Valuation and Project Analysis

Fundamentals of conducting “Financial Health Check”

Connecting the dots of Macro Economics

Bespoke Functional Trainings in Banking and Financial Services (BFSI) Space

“Good to Great” is a journey, which needs vision, thinking, planning and great execution. Pre-requisite to all this is a positive, constructive, forward looking and enterprising “Mindset”. Ability of promoters/business leaders to ask right questions and exploration of their answers can significantly distinguish an organization from others.

As Promoters/Business Leaders, have you ever asked following questions to yourself?

How do we become a deserving candidate for capital (from Banks, private investors and/or public)

How do we become a honey-pot for attracting and retaining great talent

How do we structure our business model to attract customers

How would good governance add value to business and valuations

What is the opportunity cost of not doing right things

This programme is carefully conceptualized and designed, to specifically address above questions in practical manner.

Course Contents:

Capital is fuel for any business. Both debt and equity have their positives and negatives. We will dwell on broader issues with regard to capital structure (existing and future), various sources of finance for a business and their long term impact (ownership, liquidity, cost, exits etc.). We will discuss - what investors and bankers look for in businesses and how to position the pitch to them.

Both BSE and NSE have launched SME platforms for listing of emerging corporates/SMEs in 2012. Benefits of listing are many in terms of access to capital and improved perception of stakeholders in business. Already, there are several companies listed on these two platforms. How can these platforms help you raise capital and unlock real value of your business?

Credit rating is a pre-requisite for many businesses, when it comes to raising debt. It is good to understand how rating agencies look at businesses and how can corporates improve their credit rating. Another important aspect of discussion would be how does credit rating create value for the businesses.

Growth and scalability are most magical words for promoters, investors and lenders alike. However, businesses need serious thinking on organic vs. inorganic growth (growth through acquisition) and corresponding strategies. Growth and scalability may demand infusion of significant resources (capital and otherwise) before businesses see profitability. Businesses need to focus on brand management, market positioning, customer outreach, customer engagement and distribution network.

“Restructuring”, “Cost-Cutting”, “Downsizing” etc. are buzz words in corporate circles from time to time. Sometimes, even successful and well run companies encounter difficulties as a result of hyper competition, market volatility, downturn in economic cycles and other factors beyond their control. During these times, quick assessment of challenges and unemotional decision making becomes key to survival in short term and profitability in long-term.

Business transformation gets sparked with change in thought process of promoters. Number of times, it just demands more organized approach to business and setting up priorities well, focusing on few things and saying no to others. Businesses need to focus on improving health, and, resultantly enhance their valuations. Focus of discussion here would be key drivers of business transformation.

Business environment is becoming increasingly complex and making many of us redundant at an amazing speed. Yesterday’s competencies are no more value adders. Accordingly, both individuals and organizations need to be learning machines. Further, focus of learning has to be on building conceptual clarity, a broad perspective and ability to handle situations with clear focus on solutions.

Most of the businesses in India are family owned. At some level in their life cycle, promoters feel the need to infuse talent from outside to enhance competence and continue on the journey of growth. Indeed, investors/lenders also want to see management breadth before committing capital. We will discuss importance of credible sounding board, segregation of ownership and management, setting up human resource systems (recruitment, key result areas (KRAs), appraisal etc.), setting up Standard Operating Procedures (SOPs) for each department/vertical and Management Information Systems (MIS) etc.

Another area of debate with Family Owned Enterprises is succession planning. One has to ensure transition of business from one generation to another is smooth and the interest of retiring generation is well protected.

World markets have witnessed unprecedented moves across the asset classes – Commodities, Securities, Currencies and Rates etc. Top managements, across the businesses, has voiced concern on the subject of risk management. Implications of changing asset price dynamics in the market place are many – For instance, increasing commodity prices and inability to pass on the escalated prices to customers, because of competitive pressures, infuses uncertainty in cash flows and squeezes profit margins. Similarly, sometimes, unexpected currency moves may evaporate profit margins on sale and jeopardize very existence of organizations.

CEOs, CFOs, Directors, Leadership team and Senior Management of Businesses. Participants from different functions including Sales/Marketing, Technology, Human Resource, Operations, Administration would need to be part of this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

Human beings have had the history of changing inside out to positively impact the world around. Organizations are also ever evolving without fixed operational paradigms. On one hand, changing interests, preferences, priorities, behaviors of customers and on the other hand competitive pressures are keeping businesses on toes. Successful organizations are differentiating themselves by continuously attempting to convert their managers in to leaders to lead the businesses to the next level.

It is seen through the empirical studies that organizations, which create leaders are the ones that reserve leadership position for themselves in the industry. Also, migrating Managers to Leaders demands transformation of thoughts, words and action. Accordingly, this programme aims at positively influencing the thought process of individual leaders to improve self, improve team productivity and better alignment with organizations’ objectives to deliver outstanding value proposition to the customers.

Course Contents:

This programme is envisaged to be spread over six modules with application exercises – individual/group and follow up sessions (~90 minutes) for each module.

Inspiration – Quality of your dialogue with self will determine quality of your interaction with external world.

Leading self is the spark, which becomes fire in terms of leading teams and businesses over a period of time. Every great leader across the world has first taken charge of himself. As Mahatma Gandhi said “Be the change, you want to see around”. Leadership at individual level is all about vision, determination, dedication, discipline, positivity, enthusiasm, planning, organizing, prioritizing, focus, concentration and list is endless. It is the journey of being a lot more aware about yourself and how do you react to various situations. It is about coming to driver’s seat and saying Yes! Circumstances are not in my hands but how do I respond to them is purely my choice. It is about reinventing and redefining yourself on continuous basis.

At the end of this module, you would be able to build your own growth/aspiration plan.

Inspiration – If your actions inspire others to dream more, learn more, do more and become more, you are a leader.

In businesses, while contributions are made by individuals, value deliveries to customers are made by teams. Team leaders are not only responsible for their own performance but also the performance of overall team, which, to a large extent, depends on competence, attitude and behavior of the leaders themselves. Great leaders build teams, motivate team members, encourage them to challenge their own limitations and facilitate their path to accomplishments.

This module will lead you to think team structure, team development and how to synergize team potential. You would also learn importance of collaborative relationships, Influencing, effective communication and conflict management.

Inspiration - Customer experience is the next competitive battleground.

Every organization is serving a purpose and everyone in the organization is serving customers directly or indirectly. Today, business is not about a product or a service but solution to customers delivered in a delightful manner. Customers are becoming demanding beyond imagination asking better, faster, cheaper and effective solutions. Businesses are discovering and re-discovering themselves to stay relevant to ever changing requirements of their customers. Organizations are continuously re-aligning themselves with their customers in pursuit of winning competitive battle.

This module will ignite thinking on understanding customers and their motivations to align business with them. Discussions will also revolve around how to think on building and nurturing relationships and create customer delight through offering a great value proposition.

Inspiration – In this ever changing and dynamic world, competence to think through, structure issues and synthesize solutions would be a great competitive advantage and differentiator for individuals.

In this non-linear, discontinuous and chaotic world, problems are no more what we have seen earlier. Every change leads us to a different landscape of opportunities and corresponding problems. Ability to ask relevant questions and frame problem is the first step to problem solving. Ability to think through and connect scattered dots is the way to solution. Meticulous evaluation of each possible option, decision on optimal solution, execution followed by monitoring and control are the steps in solution design.

This module will equip you with basic tools of problem articulation, possibility thinking and architecting solution.

Inspiration – Validity of any business idea is profits.

Every organization exists to serve a purpose but profits are critical for long term survival of any business. Indeed, everyone in the organization contributes towards its financial goals. Basic understanding of business financials is imperative for each individual to understand how financials work and how he or she can contribute better towards them.

This module will help you become a conscious positive contributor to business financials.

Proposed intervention aims at incorporating following key leadership skill-sets among the target audience:

Understand team structure and set clear goals and action points for self, team and individuals in team.

Clear, persuasive and confident communication of goals and action points to the team.

Prioritize, make impactful choices and intelligent allocation of prioritized work among team members (delegation).

Use communication as an effective tool with stakeholders.

Conflicts management among various stake holders through open dialogue.

Self and team motivation with a positive mental attitude and encouraging words.

Creation of a positive, productive and energetic atmosphere through inspiring others.

Understand the basics of finance and connect the business decisions/choices with improved revenue or reduced cost for the business (creating value).

This programme is meant for middle level team leaders with experience of 5-10 years. Participants from different functions including Sales/Marketing, Technology, Human Resource, Operations, Administration would benefit from this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

This programme is envisaged to be spread over 6 months with one full day module and one follow up session (~90 mins) each month (Contents to be customized as per the chosen tenor and requirements).

Functional Managers generally have management authority over an organizational unit/function within a business and are responsible for efficient and effective delivery of their functions. If we look at the role with slightly bigger perspective, these Functional Managers are decision makers responsible for resources allocation, resource utilization, productivity enhancement, cross-function integration, compliance of the organization's policies and ensuring that goals and objectives of function align with the organization's overall strategy and vision.

As organizations work as bundle of complex independent functions, it is becoming increasing critical for these functional managers to relate to the organization's larger strategic mission. Functional managers have to think strategically, prioritize objectives, capitalize on opportunities and avoid potential risks. In nutshell, Functional managers have to act like CEOs at functional level.

We have crafted this unique programme to equip Functional Managers with required competence to make them think like Business Managers – CEOs of their respective units.

Course Contents:

Purpose of an organization

Various sources of finance for the companies – Public and Private Markets, long term and short term funds, onshore and offshore funding etc.

Consideration in various financial instruments – Equity, Debt, Preference shares, Convertibles etc.

Where are funds blocked in a business (uses of funds – long term assets and working capital)

Basics of Profit and Loss Account (P/L)

Basics of Balance Sheet (B/S)

Basics of Cash Flows

Understanding Annual Reports - Chairman’s report, Director’s report, Contingent Liabilities, Off-balance sheet items, Accounting Policies, Notes to Accounts, Capital Reserves and Goodwill etc.

Important points to keep in mind while looking at financials

Quality of business in the past through quantitative lenses

Profitability ratios

Return ratios

Leverage ratios

Liquidity ratios

Efficiency ratios

Peeping into future with caution (Business Planning & Budgeting)

Peer Comparison

Discussion on equity research reports and credit rating reports on businesses to understand:

Business and Business Models

Competitive Advantages/Points of differentiation over the competitors

Strengths, Weaknesses, Opportunities and Threats (SWOT) Analysis

Pricing power and sustainability of this power

Organization structure

Critical business drivers/success factors

Risks in the business

Compliance orientation of the company

Documentation on Guidance v/s Actuals

Current state of Indian Economy and business environment

Current state of Global Economy and business environment

Relationship between Indian and Global Economic Factors

Differentiation between uncertainty and risk

Types/sources of risk (market, credit, operational, liquidity, leverage etc.)

Approach to risk management

Basic principles of risk management

Risk Management experience with Indian and Global corporates

Best practices in risk management

Value creation through risk management

This programme is meant for Functional Managers from any stream.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business. Sincerity, participation and involvement of participants would determine what they accomplish from the programme though.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

Economics is a very complicated subject. In this ever increasingly inter-linked world, small changes in one part of the world may affect the other parts of the world significantly. Further, Economics has primarily been a trial and error subject without specific answers to the questions. Behavioral dimension of people puts added layer of complexity to the already complex subject. Accordingly, Economists and Central Bankers, across the world, have always had a daunting task in front of them – How to move ahead.

It is important for everyone in business to understand big dots in economics and how to connect them at broad level to see the big picture and potential possibilities – both on positive side and negative side. With that objective in mind, this programme has been carefully crafted to add value to each participant, irrespective of the business stream, he/she comes from.

Course Contents:

Inflation, interest rates, impact of rates on Demand and Supply Currencies, imports and exports, current account imbalances, flow of forex to the country (portfolio investments, FDI, foreign borrowings etc.), gold reserve and FX reserve with central bankers

Monetary policy parameters and applications

Fiscal policy and tools, Fiscal deficit and ways to finance

Impact of oil prices on the economy, oil subsidies and government financials, controlled fuel prices (Politics vs. Economics)

Management of conflicting objectives in economies (growth vs. inflation, growth vs. rates), capitalist vs. socialistic approach, increasing inequalities among people and social consequences etc.

Genesis of Euro crisis (what happens when there is monetary union without fiscal union)

Long term repercussions of printing currency in US

Long term repercussions of negative interest rates in Europe

China and management of its currency (how the world gets affected because of Chinese currency policy of not letting it appreciate against USD; why don’t they let it appreciate etc.)

Valuation parameters and various approaches to valuation

Absolute level of index vs. valuations

Valuation of Index vs. Valuation of independent businesses

How greed and fear operate in the market

Lessons from great masters like Benjamin Graham, Charlie Munger and Warren Buffett

Behavioral dimension of market

This programme is meant for middle level team leaders with experience of 5-10 years. Participants from different functions including Sales/Marketing, Technology, Human Resource, Operations, Administration would benefit from this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

1 day to 2 days (Contents to be customized as per the chosen tenor and requirements).

Globalization, while bringing in lots of opportunities, also exposes corporates to unheard volatilities in the Financial Markets. As markets are more linked, problems in any part of the world start affecting other parts of the integrated world. Today, one can observe the movement and huge volatilities across the asset classes - equites, currencies, commodities and rates.

n this ever increasingly complex world, we have little control over the events and so the uncertainties and corresponding risks arising from there. However, we can always control the risk/loss to us from these events through prudently using financial products called “Derivatives - Risk Management Products”. If not paid attention to, these risks can endanger very existence of organizations.

Accordingly, this programme is carefully designed to equip market participants with clear understanding of various risks, variety of risk management products and their applications.

Course Contents:

Differentiation between uncertainty and risk, Types/sources of risk (market, credit, operational, liquidity, leverage etc), approach to risk management, Basic principles of risk management, Risk Management experience with Indian and Global corporates, best practices in risk management, Value creation through risk management.

Introduction to derivatives, Need for derivatives, Types of derivatives (Forward, Futures, Options, swaps etc.) and comparison between them, OTC Vs. Exchange Traded Products, Participants in the derivatives market (Hedgers, Speculators, Arbitrageurs)

Product Terminology - Contract specifications, concept of basis, mark to market, Tick size, Types of orders, Settlement types - Cash v/s Physical settlement, Open interest and Trading volumes, competitive advantages between forward and futures contracts. Hedging strategies with forward and futures

Product Terminology – Various types of options (Calls, Puts, American, European, Bermuda, Asian, Knock In, Knock Out, Digital/Binary etc.), participants (writer/seller, buyer), premium, intrinsic value, time value, settlement mechanism, strike price, ATM, OTM & ITM, Introduction to Option Greeks - Delta, Gamma, Theta, Vega etc., pay-off profiles of various kind of options, views behind each option position.

Settlement at expiry, exercise of options and exit through squaring off/reversing the transactions.

Hedging strategies using options for FX and interest rate risks. Manufacturing of structured products/Zero cost structures using options.

Functioning of FX market, Understanding of FX risks on Asset and Liability side with various examples, products, Accessibility to various products based on prevailing regulations, documentation requirements.

Risk identification and measurement (both active and passive excesses), segregation of front and back office functions, concept of Value at Risk, Methods of risk control (Position limits, Margins/Collateral based trades, Operating Procedures and systems etc.), Computation of margins like Initial margin, MTM etc.

Existing regulatory provisions, Discussion on philosophy behind various regulatory provisions

This programme is meant for Finance and Treasury mid-level and junior professionals. Risk management professionals would also find significant value in this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

As all Business Decisions are analyzed in light of their strategic impact on the bottom line (profits), finance assumes the core position among all the activities undertaken by a business entity. Therefore, it has become virtually imperative for everyone in the organization to understand the basic dimensions of finance to profoundly analyze the proposals and contribute positively towards organizational goal – Profits. Studies reveal that Fundamentals of Finance, if proliferated in an organization well, indeed, become a competitive advantage for it.

Accordingly, this programme is crafted with care to equip Non-Finance Managers and Decision Makers with required knowledge of finance to align their actions with organizational goal – “Profitable Growth”.

Course Contents:

Purpose of an organization

Various sources of funds for business

Application of funds

Importance of matching long/short term financing needs with the long/short term funds.

Common shares, preference shares, debentures, hybrid instruments like convertibles, warrants, all money market instruments like CPs, bank financing, factoring, forfeiting, bill discounting etc. Comparative analysis of various sources of funds – competitive advantages and disadvantages

Cost of capital (cost of equity and debt and other instruments)

Relevance of calculation of the cost of capital and its relationship with the business returns

Introduction to the corporate actions like bonus, split, consolidation, right, dividend, buyback etc., underlying reasoning behind them and their impact on the B/S. of the company and the share price of the company

Concept of gearing / leveraging

Management of short term funds and long term funds (investment avenues for corporates)

Values of the business entity – market value, liquidation value and book value

Intangibles like brands, human resources, patents and their values

P/L account – Various cost concepts including fixed and variable costs, marginal cost and concept of Break Even Point

Difference between cash and non cash expenses

Difference between capital and revenue expenses

Discussion on various risks – default risk, currency risk, interest rate risk etc.

Concept of risk management and insurance

Discussion on some financial ratios and their interpretations – profitability, leverage, return ratios, market price to book value, P/E etc.

Concept of EPS, DPS etc.

This programme is meant for Non-Finance Managers and Decision Makers at various levels. Participants from all the functions including Sales/Marketing, Technology, Human Resource, Operations, Administration would benefit from the programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

This programme aims at providing participants with a thorough understanding of how to build a robust Financial Model from start to finish. Model to cover revenues, operating and maintenance costs, capital expenditure, depreciation, debt and equity financing and taxation, leading to integrated financial statements for the entity in question. The model to also provide an ability to run different scenarios and adjust the timing of key events. During the course, participants will also gain an insight into how to tailor the outputs of the model to end users, interpret the results and run sensitivities, as well as perform some degree of testing to reduce the incidence of modeling errors.

The course is highly interactive, comprising of a mix of theory, group discussions, instructor-led demonstrations and Excel-based exercises for participants to undertake.

Course Contents:

Overview of Key Excel Functions

Customizing Worksheets

Important features to be looked into the financial modeling

Check-list for building up financial model

Time Value of Money

Discussion on Interest rates

Linkages between Time Value of Money and application of the same in the financial modeling

Preparation of Financial Statements – P/L, B/S and cash flows

Financial Analysis using Ratios

Discussion on the techniques of Project Evaluation

Discussion on calculation of IRR and NPV methods of evaluation

Pitfalls of IRR

Valuation of stocks (dividend growth model)

Valuation of stocks using DCF analysis

Two Stage Growth Model

Three Stage Growth Model

Calculating Enterprise value

Goal Seek for Backward Working

Scenario Analysis

Single Variable Sensitivity Analysis

Two Variable Sensitivity Analysis

This programme is meant for Finance and Treasury mid-level and junior professionals. Risk management professionals would also find significant value in this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

It is every professional’s dream to secure an MBA from a renowned B-School. B-Schools provide great education and sometimes bring-in a radical shift in the thinking of participants. However, many of us are not able to join B-Schools; and, even if we did one, it does not guarantee success in life. Fact is that MBA is an experience and many of these B-Schools are not able to create required environment/atmosphere for that experience for several reasons. Also, several studies reveal that many of these B-Schools need re-thinking on their curriculum and what they want to accomplish through their students.

Objective of this program is to highlight what truly matters in the life to succeed. Technical skills become irrelevant over a period of time; however, core soft skills never go out of fashion. This programme will highlight several facts, which would help participants enhance their efficiency and effectiveness to enable them to contribute at higher level towards organizational goals.

Course Contents:

Life by design

Lead self to lead a business

Lead teams to lead a business

Principles Centered Leadership

Importance of relationships in success

Calculated risk taking

Finding solutions through unleashing creativity and imagination

Simplicity as a great virtue

Develop ability to ask questions

Become a learning machine

Learn basics of money and money management

Mindfulness

This programme is most suitable for middle management and junior resources of any large organization. However, anyone who wants to enhance his performance would find this programme interesting and value creating. Participants may or may not have any prior degree for undertaking this programme.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

3 days to 5 days (Contents to be customized as per the chosen tenor and requirements). Best impact is seen when companies execute this programme over a period of several months in smaller capsules of half day to a day each month.

Customers are spoiled by choices and competing products in the market place. Ever increasing competition has made acquiring customers and retaining them quite daunting task for businesses. Constantly changing tastes and preferences of customers have resulted in decreasing brand loyalty. Today, organizations need to continuously analyze needs of their customers and reinvent ways to engage with them and create perceived values.

Objective of this program is to discuss step by step process to reinvent traditional methods of approaching customers and engaging with them. This program would focus on enhancing customer engagement, strategies to retain long standing relations as well as acquiring new customers.

Course Contents:

What do you actually mean by Customer Engagement

How well do you know and understand your customers

Do you do regular “Customer Health Checks” (feedback)

Importance of knowing your customers well before meeting them

Expanding the concept of customer service

Know your brand well- Building a strong brand with higher retention value

How to escape competition through differentiation

Keeping updated with changing preferences of customers

Forming customer engagement strategy

Approaching different types of customers in different methods- customer profiling

Keeping updated with newer technologies to stay connected with customers

This programme is meant for Business Development/Sales/Marketing team of medium to large organizations. We have also delivered lighter model of this programme creating lots of value for people from support, operations and other functions as ultimately everyone in the organization works for customers.

This programme would be delivered in hands-on, simple, interactive, engaging and case studies manner. Role of facilitator would be to let the group discover new horizons of thought process to create value in the business.

2 days to 3 days (Contents to be customized as per the chosen tenor and requirements).

Address :

Value Ideas Investment Services Pvt. Ltd.

301/Wing A, Golden Rays, Raheja Vihar, Powai, Mumbai – 400072, INDIA.

© 2016 Xcelerating Minds. All rights reserved. | Designed & Developed By TechnoBase IT Solutions Pvt Ltd.

Sunil brings to the team 35 years of SME business, legal, taxation and real estate experience. He is also an investor both in listed and unlisted space businesses. His common sense approach to legal, taxation and business issues is always a great value creator for business.

He has done SME Programme from Indian Institute of Management, Ahmedabad. He also holds Bachelor’s degree in Commerce from Mumbai University.

He can be reached at sunil@Xceleratingminds.com

Manish brings to team over 20 years of experience in diverse fields including Investment Banking and consulting (SME Value Advisors), listed space investing (Jeetay Investments Pvt. Ltd., India), sales and business development (Citibank, India), regulatory (Securities and Exchange Board of India – SEBI, India) and business analysis (Institute of Chartered Financial Analysts of India – ICFAI, India). Diversity in his experience imparts him with great ability to structure issues and synthesize potential solutions in any given business situation.

He has done his M.S. in Business Administration from University of Maryland, U.S. He also holds other degrees like MBA, CFA and Licentiate in General Insurance.

He has been sharing knowledge continuously from different platforms such as Bombay Stock Exchange (BSE), National Stock Exchange (NSE), Multi Commodity Exchange (MCX), Dun and Bradstreet (DnB), Credit Rating and Information Services India Ltd. (CRISIL) and various industry bodies like FICCI, ASSOCHAM, CII etc. He also serves as visiting faculty to prestigious Institutes including Indian School of Business (ISB), Hyderabad, Indian Institute of Management (IIM), Bangalore, Indian Institute of Technology (IIT), Mumbai and several others. In addition, he has several publications to his credit.

He can be reached at manish@Xceleratingminds.com

Athithya brings with six years of experience providing exemplary support in IT industries. Consummate multi-tasker who can balance competing and shifting priorities with ease. In span for 6 years worked for multinational to Start-ups Company. Expertise in digital marketing as well as Business Development and helped 50+ start-ups to gain brand in market place.

She earned her Master of Business Administration from Madurai Kamaraj University, Tamil Nadu. Her responsibility here includes enhancing the training and programmes as well as increase the brand awareness to various educational sectors.

She can be reached at athithya@xceleratingminds.com

Chaitri brings 2 years of mixed bag experience in investment banking & marketing. She is a team player, a multi tasker & can manage priorities in time with ease. She has earned her Bachelors & Master’s degree in Financial Markets from Mumbai University & IGNOU’s affiliation with Bombay Stock Exchange(BSE) simultaneously. Her role at Xcelerating minds involves conducting training programmes & enhancing brand awareness within the corporate sector.

Ranjana Bang brings 2 year experience in marketing, worked with Computer Institutes - Tata Unisys and NIIT as marketing executive. She had done graduation in Science and M B A in marketing from Marathwada University Aurangabad. She had also done 1 year diploma in Computer software.

She can be reached at ranjana@xceleratingminds.com

Parag is a graduate in Bachelor of Commerce with Masters in Business Administration in marketingand is based in Mumbai. He is a seasoned professional with experience of over 30 years in Sales, Marketing and General Management: largely in the Office Automation, Risk Management, Consulting, Research& Credit Rating Industries. Parag has workedwith reputed institutions in their startup phase and was a key member of various teams set up tonurture the companies towards sustainability. These companies include: Xerox Corp (earlier known as Modi Xerox Ltd), RPG Ricoh Ltd,Dun& Bradstreet India & SMERA Ratings Ltd.

Further, Parag played a pivotal role at Dun & Bradstreet (D&B) in India & the Middle East by setting up its sales division for Risk Management, Researchas well as Advisory practice with a career spanning over 14 years with them. Before joining his latest firm: Equentis Wealth Advisory Services, where Parag was instrumental in setting up investment as well as research divisions & procuring SEBI license, he was a CEO of SMERA Ratings Ltd (a joint venture of SIDBI//D&B and various banks) with an eventful career spanning 6 years at the helm. During this stint at SMERA, Parag managed to convert a loss making business to a profit making & a dividend paying company.

In the process of building these companies from a startup phase, Parag has learnt the most difficult art in management: building and managing companies to a sustainable phase.Creating and training sales teams has been Parag’s key skill set acquired during his career spanning over 30 years.

For Parag, who is steeped in legendary RankXerox’s sales & other variant of its trainingregimen (also consultative training skills from Dun & Bradstreet), training comes naturally to him.Paragbelieves in creation of high performance and ownership driven teams wanting to contribute to thebest of their capabilities.In all the companies that he has worked in the leadership position since RPG Ricoh, he was instrumental in developing strong leaders within his team who occupy key positions in various firms. Parag’s successful stint at the firms mentioned above stems from his keen eye in spotting talent, nurturing them and imbuing them with team spirit to achieve company goals. He is a firm believer in building cohesive culture striking balance in performance, rewards, ethics& accountability.

During his 20 years with Dun & Bradstreet and SMERA Ratings Ltd experience, Parag has presented to domestic as well as international audience comprising of bankers, regulators, credit guarantors, various industry associations, exporters, International multilateral & govt. agencies thus exposing him to multifarious audiences, thereby honing his presentation skills to suit his audiences. Thus, amongst various skills, strong presentation skill is one of Parag’s key professional strength acquired while working in the corporate set up.

Parag is married with 2 children and resides in Thane.

Murali brings to the team more than 25 years of illustrious experience in the field of Finance, Accounts, Taxation, Legal and Corporate Finance. His fields of expertise are project finance, working capital management, audits, taxation both direct & indirect taxation, compliance and due diligence (s), secretarial and corporate law matters. In-depth understanding of business issues and eyes for details make him a great resource for team.

His academic record is quite exemplary with high ranks in all the professional examinations such as CWA, CA, CS, M.Com, LLB and MBA (project finance).

He can be reached at murali@Xceleratingminds.com

Rajesh brings to the team around 20 years of extensive experience in the industry including over 10 years in Asset Management and Investment Advisory. He is currently an Investment Consultant to a large family office based in Dubai, UAE. Previous to that he was associated with “Credit Suisse, Dubai” as an External Fund Advisor to provide non-discretionary Investment Advisory and Portfolio counselling services to High Net-worth Individuals. Rajesh also worked with Lucros Capital Advisors Limited – A DFSA regulated Hedge Fund as Head – Research and Esvee Capital, a proprietary Fund owned by a large family office in UAE as Sr. Equity Analyst. He has extensive experience in setting up regulated GP and fund structures in Dubai (DFSA) and Cayman Islands/Mauritius; his key competency areas are equity research, data analysis with an understanding of business requirements in various international environments and he is well versed with regulatory requirements for financial services in different geographies such as India, UAE, Cayman Islands, and Mauritius.

He is a Chartered Accountant (ACA) and has Executive MBA degree from NMIMS, Mumbai.

He can be reached at rajesh@Xceleratingminds.com

Sheetal brings to the team more than 10 years of general administration, project management and marketing experience. Over the years, she has been working with start-ups and involved in Strategy formulation and business development. Also, over last 5 years, she has been associated with ShreenathjiDyanda Charitable Trust (SDCT) as Committee Member and administrator at SDCT’s Technical Institute.

She earned her Bachelor’s in Pharmacy from Pune University and Post Graduate Diploma in Pharmacy Management (PGDPM) from SIES College of Management Studies, Mumbai.

She can be reached at sheetal@Xceleratingminds.com

Dr. Abhijit is Director at Giltedge Financial Counsel Pvt. Ltd.He brings with him more than 30 years of experience in consulting and strategic management with specific focus on new business initiatives. He has worked in senior positions with Indian subsidiaries of two global investment banks, served on the board of a leading co-operative bank, spent time with manufacturing and consulting sectors in a wide variety of interesting engagements. Understanding of business issues and eyes for details make him a great resource on Financial Modeling and Business Valuation, end to end structuring and integration in Mergers and Acquisitions, setting up internal procedures and operations in businesses etc.

His academic record is quite exemplary with high ranks in all the professional examinations such as CWA, CA, CS and CFA. He was recently awarded a PhD by IIT Bombay for his pioneering work on ‘Factors influencing investments into Indian states’.

He has been sharing his experience through executive education engagements, delivered through various platforms including Dun & Bradstreet, CRISIL, Shailesh J. Mehta School of Management, IIT Bombay, Giltedge Financial Counsel Pvt. Ltd. and several other esteemed organizations.

Dr. Anil Menon brings with him more than twenty years of experience in the field of Financial Services & Investment Banking. He is known for his skills on Financial Modeling, Business Valuations, Mergers and Acquisitions and issues in Family Managed Businesses (FMBs). His tenure as Assistant Vice President at SBI Capital Markets Ltd., a premier investment bank in India, has equipped him with necessary investment banking competencies. He is also closely associated with Family Managed Business (FMB) program at S. P. Jain Institute of Management and Research, Mumbai.

His academic qualifications include Bachelors in Production Engineering from Mumbai University, Master of Management Studies (MMS) from Jamnalal Bajaj Institute of Management Studies and doctorate in Mergers and Acquisitions.

He is a sought after speaker and shares his knowledge from various prestigious platforms on Financial Markets and Investments. He has conducted customized training on Corporate Finance, Financial Modeling and Structuring for SBI Capital Markets, Godrej Industries, General Motors, Patni Computers, GVK, HDFC Standard Life, ILFS etc.

Gurudatta has around one and a half decades of extensive experience in Equity Research, Investment Advisory and Portfolio Management. Along with his entrepreneurial stint in initial phase of his working life (civil contract and interior designer), he has worked with reputed securities broking firms such as MotilalOswal and Almondz supporting proprietary Trading desks and clients such as Bank treasuries and Mutual funds.

His key competency areas are Training and Research. He used to be quoted in print media quite often and appeared on TV continuously between 2008 to 2010. His excellent communication skills and command over the basics of finance have taken him to various reputed platforms to share his knowledge – Bombay Stock Exchange (BSE), National Stock Exchange (NSE), NISM and several prestigious Institutes including Jamnalal Bajaj Institute of management Studies (JBIMS), Government Law College (GLC) etc.

His academic qualifications include B.E Civil and ‘Certificate course on Capital Market’ from BSE Institute Limited.

Sumita Datta (PhD) is Managing Partner at Bridgit Nterprise LLP, an OD Consulting, Training and Coaching organization, concentrating on organizational capability building and leadership development. In addition, she is Associate Professor (adjunct) in the People &Performance area at S.P. Jain Institute for Management & Research, Mumbai. She is also SHRM India Master Facilitator. In independent capacity as well as a Senior Associate with Grow Talent and Great Place to Work, India, she successfully completed several assignments for medium and large corporate houses dealing with change management, vision & mission exercises, career transitioning, competency assessment, talent management, leadership development and other critical people interventions since July 2005. From July 2012till September 2013, she headed the Learning and Leadership Development function of Siemens (South Asia) based out of Mumbai, responsible for driving their talent strategy in the South Asia region through a robust Learning & Development landscape.

A Post Graduate in Personnel Management & Industrial Relations from XLRI Jamshedpur (1992) with academic Concentration in Organization Behaviour, she received her PhD. from IIT Bombay in2010. She is a certified MBTI, Saville, EQi 2.0 and NLP Practitioner. She is a certified Integral Coach of New Ventures West, USA and Associate Certified Coach from ICF. Prior to joining academics in 2009, Dr. Datta has had full time corporate experience of more than 15 years since 1992. As HR Manager in Eveready Industries (Nov. 1992 - Sep. 2000), she focused on post- acquisition cultural integration, Training & development, corporate restructuring among other operating responsibilities during her tenure. As Head HR- Corporate Centre, Mahindra & Mahindra Ltd.(July 2001 – June 2004) she acquired extensive experience in the areas of Organizational Change and Development, Resourcing, Performance Management, Compensation Management, HR Information System and HR support to incubating group companies.

In her academic role at S.P. Jain, Dr. Datta is actively engaged in evolving the organizational and family processes in the Family Managed Businesses, which have tremendous potential for growth. With special interest in enriching the role of women in the sphere of business, she conducts specialized programs for women leaders.

Dr. Datta has co-authored several scholarly articles in refereed journals such as Career Development International and IMR as well as International Conference Proceedings. Her research paper on Talent Development Climate, got acclaimed in the Best Paper Award (2012) category by the Academy of Management, Boston USA.

Ramu Shankarrao has over 23 years of experience in Healthcare industry with giants like Medtronic and St. Jude Medical. His last corporate assignment was with St. Jude Medical as Director of sales and marketing responsible for growing and managing the business and teams in South Asia. Subsequently, he had a short stint in academia with S. P. Jain Institute of management and Research, Mumbai for about 3.5 years teaching and researching in the area of sales, marketing and business plan.

He is the founder and Director of Sangatikarana Corporate Service Private Limited. In his current role, he works with companies to drive sales and marketing efforts, strategy and organization growth. He advises clients ranging from Fortune 500 companies to family-owned business. He coaches business owners and professionals towards achieving the revenue and profit growth. He spends much of his time coaching senior leaders on how to align their teams for ultimate success.

He is a passionate trainer and has conducted training programs for companies like Covidien, Kimberly Clark, Medtronic, Cisco etc. By way of skill building programs, he helps companies build strong frontline sales team to SBU heads. He received his postgraduate and undergraduate degrees from Karnataka University.

Manish Bansal is an Entrepreneur, Investor, Author and Keynote Speaker. At present, he is CEO of SME Value Advisors, an investment and consulting firm, which partners with Emerging Corporates/SMEs to take them to the next level. Over last 20 years, he has worked with several reputed organizations such as Citibank, Securities and Exchange Board of India, Institute of Chartered Financial Analysts of India etc.

He has been a speaker in various programmes, both National and International, organized by distinguished institutions such as Bombay Stock Exchange (BSE), National Stock Exchange (NSE), Multi Commodity Exchange (MCX), Dun and Bradstreet (DnB), Credit Rating and Information Services India Ltd. (CRISIL), Institute of Chartered Accountants of India (ICAI), Institute of Company Secretaries of India (ICSI) and various industry bodies such as FICCI, ASSOCHAM, CII etc.

He has also visited various prestigious Institutes including Indian School of Business (ISB), Hyderabad, Indian Institute of Management (IIM), Bangalore, Indian Institute of Technology (IIT), Mumbai and several others as a speaker. In addition, he has several publications to his credit including a book published by McGraw Hill– “Derivatives and Financial Innovation”.

Academically, he has done his M.S. in Business Administration from University of Maryland, U.S. He also holds other degrees like MBA, CFA and Licentiate in General Insurance.